LogicBio Therapeutics, Inc.

65 Hayden Avenue, Floor 2

Lexington, MA 02421

NOTICE OF 20202022 ANNUAL MEETING OF STOCKHOLDERS

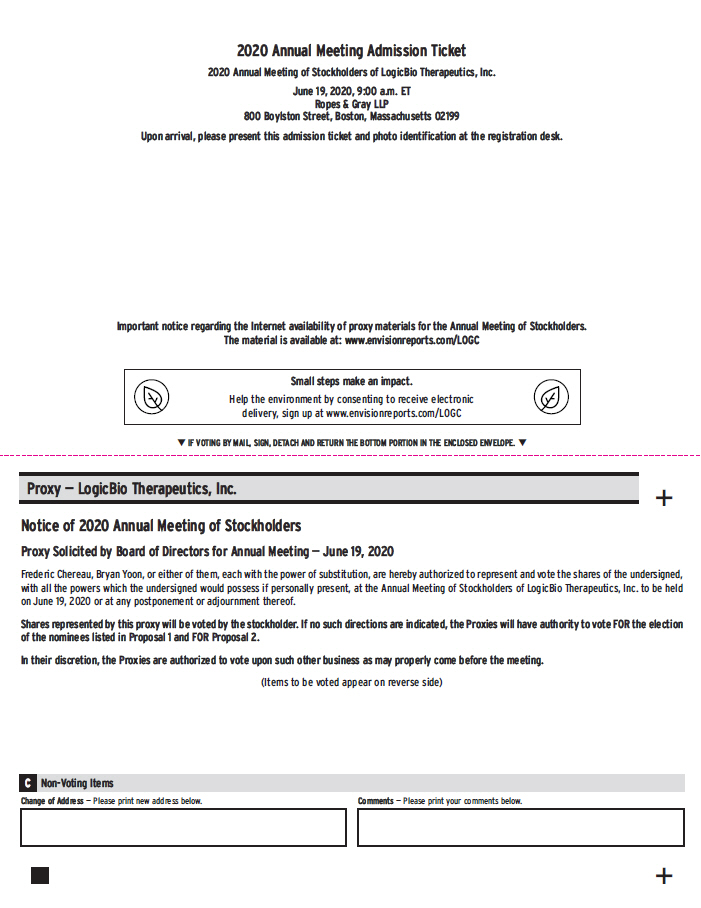

The 20202022 Annual Meeting of Stockholders, (the “Annual Meeting”)or the Annual Meeting, of LogicBio Therapeutics, Inc. (the “Company”, or “LogicBio”)the Company or LogicBio, will be held on Friday, June 19, 2020,17, 2022, at 9:10:00 a.m. E.T. at Ropes & Gray LLP, 800 Boylston St., Boston, Massachusetts, for theEastern Time, or ET, in a virtual meeting format. The purpose of consideringthe Annual Meeting is to consider and votingvote on the following two company-sponsored proposals:

| 1. | To elect |

| 2. | To ratify the |

We will also consider and act upon any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

These proposals are more fully described in the Proxy Statement accompanying this Notice. This notice, the proxy statement and our Annual Report onForm 10-K for the year ended December 31, 2019 (the “Annual Report”) can be accessed at the following website: www.envisionreports.com/LOGC.

| 3. | To consider and act upon any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof. |

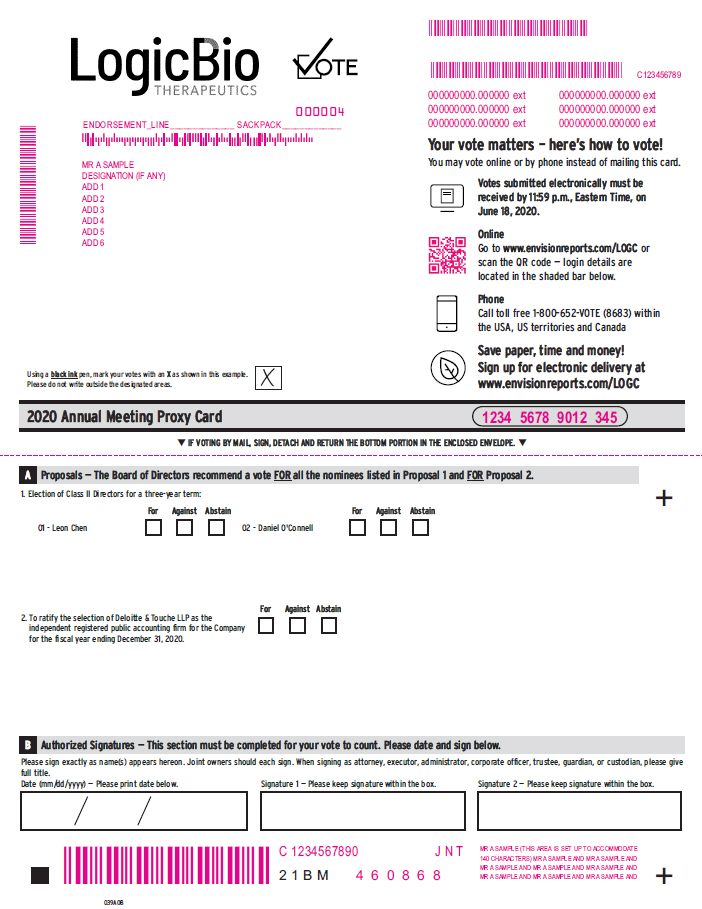

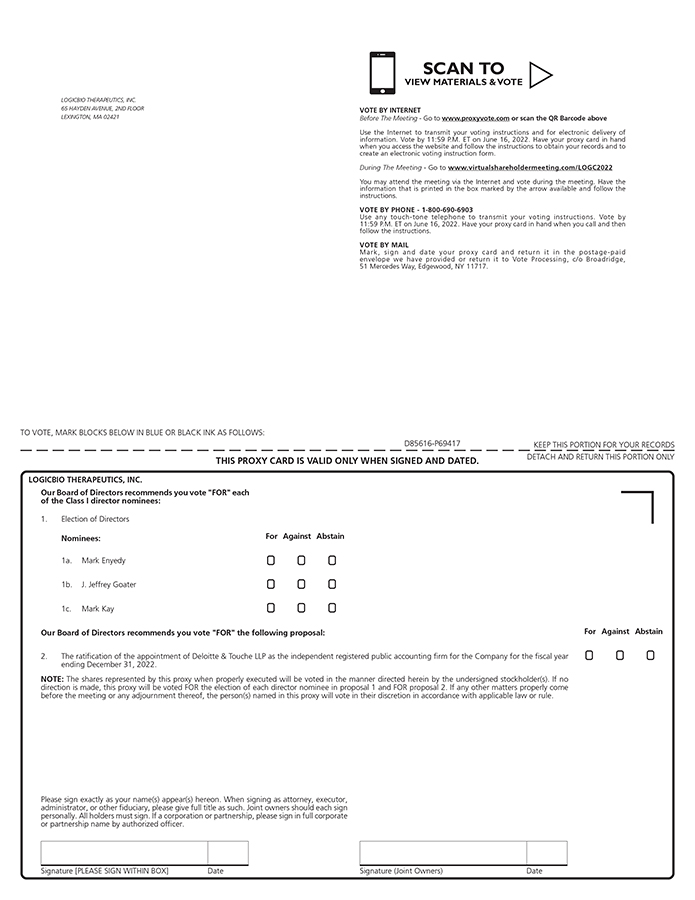

Our Board of Directors recommends that you vote “for”“FOR” each nominee forof the Class III director (proposal no.nominees (Proposal 1) and “for”“FOR” the ratification of the proposedour independent registered public accounting firm (proposal no.(Proposal 2).

Each outstanding share of our common stock, par value $0.0001 per share (Nasdaq: LOGC), or our Common Stock, entitles the holder of record as of 5:00 p.m. ET on April 22, 2020 has been fixed as26, 2022, or the record date, for the determination of the stockholders entitled to receive notice of, and to vote at, the Annual Meeting or any adjournments thereof. A list of stockholders as of the record date will be available for stockholder inspection at the headquarters of the Company, 65 Hayden Avenue, Floor 2, Lexington, MA 02421, during ordinary business hours, from June 9, 2020 to the dateadjournment or postponement of the Annual Meeting. The list

You will also be available for inspection atable to attend the Annual Meeting.Meeting virtually, vote your shares during the Annual Meeting, and submit questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/LOGC2022 and using your unique control number found on the Important Notice Regarding Availability of Proxy Materials for the Stockholder Meeting To Be Held on June 17, 2022, or the Notice, or the proxy card. You will not be able to attend the Annual Meeting physically in person. If your shares are held with a bank, broker or nominee, please refer to the materials provided by your bank or broker for voting instructions.

We are also pleased to take advantage of U.S. Securities and Exchange Commission, or SEC, rules that allow companies to furnish their proxy materials over the Internet. We are mailing our stockholders the Notice instead of a paper copy of our proxy materials. The Notice contains instructions on how to access the documents and cast your vote by Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials. Stockholders who previously elected not to receive a Notice will instead receive a paper copy of the proxy materials by mail. The notice and access process allows us to provide our stockholders with the information they need more efficiently, while reducing the environmental impact and lowering the costs of printing and distributing our proxy materials.

Your vote is important. Whether or not you expect to attend the Annual Meeting virtually, we urge you to vote your shares by following the instructions in the Important Notice Regarding the Availability of Proxy Materials that you previously received and submit your proxy by the Internet, or telephonephone or by signing, dating and returning the proxy card included in these materials by mail in order to ensure that your vote is recorded. If you choose to attend the Annual Meeting virtually, you may still vote your shares in person,during the Annual Meeting, even if you have previously voted or returned your proxy by any of the methods described in our proxy statement. If your shares are held in a bank or brokerage account, please refer to the materials provided by your bank or broker for voting instructions. If you need assistance voting your shares, please call Bryan Yoon, Esq., Corporate Secretary of the Company, at (617)245-0399.

All stockholders are extended a cordial invitation to attend the Annual Meeting.Meeting virtually. Thank you for your ongoing support of and interest in LogicBio Therapeutics, Inc.LogicBio.

By Order of the Board of Directors, | ||||

| ||||

Frederic Chereau | ||||

President, Chief Executive Officer | ||||

April 29, | ||||

* We intend to hold our Annual Meeting in person. However, we are actively monitoring thecoronavirus (COVID-19) situation and are sensitive to the public health and travel concerns our stockholders may have and the protocols that federal, state, and local governments may impose. In the event it is not possible or advisable to hold our Annual Meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting solely by means of remote communication. If we take this step, we will announce the alternative arrangements via press release, which will be filed as Definitive Additional Materials with the SEC, and details on how to participate will be available at www.envisionreports.com/LOGC.